Credit Report

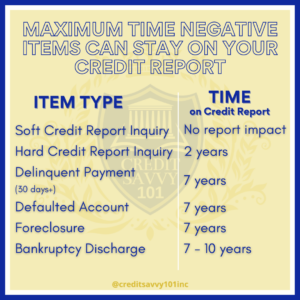

Credit report information can have a lasting impact on your credit score. That’s why it’s important to understand the different types of information that can be reported and how long this information will stay on your credit report. In general, negative information will remain on your report for between seven to ten years, but this varies by type of information and state law.

Negative items can have a significant negative impact on your Credit Repair Doral, which can prevent you from achieving your financial goals. To improve your score, it’s important to focus on building a positive credit history. That means paying your bills on time and maintaining a low balance on your accounts. However, if you’ve struggled to pay your debts in the past, it may take a while for these items to disappear from your credit report. The good news is that most derogatory marks eventually fall off your report, even if you haven’t fully paid them off.

How long credit reporting companies can report your credit activity varies by type of account and state law. But in general, the length of time that a negative item stays on your report depends on how late you were with the payment and how long it was delinquent. For example, a missed payment will typically remain on your report for seven years from the date of your last on-time payment, while an unpaid collection account will show up for five to 10 years.

How Long Do Negative Items Stay on My Credit Report?

It also depends on whether the account is a credit card or a loan. Credit cards typically have a seven year reporting limit, while loans like auto and mortgages have a ten-year reporting limit. After this period, the account will typically ‘age off’ your report, meaning it will no longer be visible to lenders.

The aging of credit report information is important because it can help you determine if you’re ready to apply for new credit. For example, if you’re nearing the end of your seven-year bankruptcy reporting period, you’re likely to be approved for a mortgage or auto loan, but it might not be a good idea to apply for a credit card. If you’re close to the end of your reporting period, it’s a good idea to check your credit reports periodically so you can see when old accounts start to drop off your report.

The most common types of negative information that are still impacting your credit report are charged-off trade lines and unpaid collections. Charged-off trade lines can stay on your report for up to seven years from the original missed or late payment, and unpaid collections can be listed indefinitely. However, if you negotiate with the collections agency for a pay-for-delete agreement, these items will be removed from your credit report as soon as they’re paid, which can help speed up the process of improving your credit. However, keep in mind that the most recent credit score models do not factor in paid collections, so if you can’t negotiate a pay-for-delete with your creditor, it’s likely that these items will continue to affect your credit.